The birth of a child is a special time for parents. In the first few weeks after birth, they want to fully focus on family life. For this purpose, the German state provides parental allowance. What exactly is parental allowance, and how does it affect your tax return? The answers to these questions can be found in our article today.

Income tax on parental allowance – what is parental allowance?

The parental allowance granted in Germany is intended tocompensate new parents for the salary lost by one of them due to starting child care. This type of financial support enables parents to not think about employment for a while and focus on their little child.

Parental allowance – how is it paid?

The parental allowance can be divided between the parents for a maximum of fourteen months.The parents can – as a couple and in accordance with the law – decide themselves how to divide the months. One parent can claim parental allowance for a minimum of two and a maximum of twelve months. Furthermore, parental allowance is paid for an additional two months if the partner is also involved in child care. Single parents raising children are entitled to parental allowance, which is paid for fourteen months. For children born from September 1, 2021, onwards, parental allowance is also paid for up to four additional months if they are born at least six weeks before the estimated due date. The duration of continued payment depends on the number of weeks the child is born before the expected due date.

Taxation of parental allowance – what is Parental Allowance Plus?

Parental Allowance Plus is an additional financial support for recipients of parental allowance, who want to balance family and work and plan to return to part-time work. Mother and father can therefore receive this additional parental allowance twice as long as the basic parental allowance – one month of basic parental allowance is equivalent to two months of Parental Allowance Plus. If both parents are not employed after the birth of the child, Parental Allowance Plus amounts to up to 50% of the regular parental allowance, but over a longer period of time. However, if mother and father work part-time, it is possible to receive as much Parental Allowance Plus as the monthly basic parental allowance.

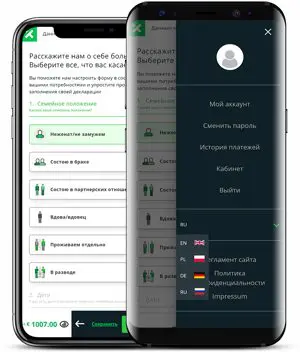

A simple tax return in 12 minutes?

Choose Taxando!

Tax refund on parental allowance – how do I get the partnership bonus?

You can apply for the partnership bonus for at least two and a maximum of four months. Each parent has the opportunity to receive up to four additional months of Parental Allowance Plus as a partnership bonus if they simultaneously work part-time (between 24 and 32 hours per week) during this time to have more time for child care. The partnership bonus also applies to parents who live apart and work part-time together. Single parents are entitled to the full partnership bonus.

Payment of tax refunds for parental allowance – who can receive the money?

Parental allowance in Germany is available to the mother or father who lives with the newborn child in a household. This situation also applies to adopted children. It does not matter if you were employed, self-employed, unemployed, or a student before your child’s birth. The requirement is that you do not work, or do not work more than thirty hours per week, after the birth of the child. If one parent works in Germany and the other lives in Poland, you can apply for parental allowance. However, be sure to apply in the country where the other parent and the child live.

In addition to parental allowance, there are other state benefits for families. One of them is the child bonus, which is paid as an additional financial support and helps parents better manage the costs of child care. It is worth checking and applying for all available benefits.

Parental allowance in the tax return – when do I not receive the money?

There are cases in which you cannot receive parental allowance. These are the following cases:

- You are caring for a child during paid leave and therefore do not take parental leave.

- ,

- You and your partner earn more than €300,000 a year together or more than €250,000 a year as a single parent.

Is parental allowance tax-free?

Parental allowance is tax-free – you do not have to tax it. However, it is subject to the so-called progressive tax clause, i.e., it is considered when calculating the tax rate. This can mean, for example, that you may move into a higher tax rate and have to pay more taxes on the rest of your income. For this reason, you must declare the parental allowance in your annual tax return.

Application for maternity allowance from tax refunds

To receive parental allowance, a written application must be submitted to the parental allowance office, but only after the child’s birth. This has to be done within the first three months after birth. Parental allowance can be applied for retroactively for up to three months before the application. What documents do I need, besides the completed application form, to apply for parental allowance?

- The child’s birth certificate.

- Copy of the identity card.

- Proof of previous income (pay slips of the last twelve months before the child’s birth or a current tax return).

- Certificate from the employer regarding maternity allowance and granted parental leave.

- Existing insurance coverage (provide proof with a copy of your insurance card or proof of private insurance).

Since each application for parental allowance is reviewed individually, you may need additional documents.

How does parental allowance affect the parents’ tax burden?

The basis for the calculation of parental allowance is the average net income of one parent in the year before the child’s birth. This amount ranges between €300 and €1,800 per month. Since the final amount is influenced by a number of factors, it is not possible to provide an exact answer to the above question. However, a free tax return program for Germany can help. With it, you can estimate how much support you will receive from the state.

Maciej Wawrzyniak

In his private life, Maciej enjoys sporting challenges, playing the guitar, and swimming in the lake. He is also the proud father of three sons.