Imagine the management gives you a raise, but you can still afford less and less – this is what we refer to as bracket creep. This phenomenon is influenced by rising inflation and higher tax rates. In this article, we explain the mechanisms of this process, describe who it affects the most, and how the German government is trying to combat it – welcome.

Definition of bracket creep – what is it exactly?

A fundamental mechanism of the German tax system is progressive taxation, which stipulates that people with higher incomes pay higher tax rates. Nevertheless, sometimes a phenomenon can be observed known as bracket creep, which has some unexpected effects and negative consequences for the population and the economy.

Salaries steadily rise, but due to higher taxes, the standard of living decreases – this is the simplest explanation for bracket creep. The salary loses purchasing power due to inflation and higher income tax must be paid because of the increased wages, thus increasing the burden. Although more money appears on the paycheck, the real income is significantly lower since fewer goods and services can be purchased – however, the taxes to be paid rise progressively.

Bracket creep thus means the absence of an adjustment of tax brackets to inflation or the rising income of society. As a result, although the nominal tax rates remain unchanged, the real value of the tax brackets decreases with inflation. This means that people whose incomes do not grow as fast as inflation could pay higher taxes.

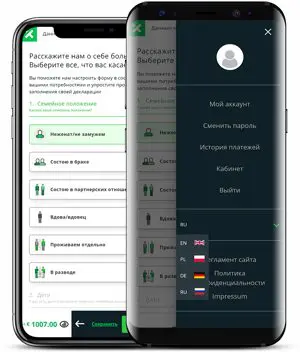

A simple tax return in 12 minutes?

Choose Taxando!

Bracket creep – significance for taxpayers and the economy

Bracket creep in taxation has several negative impacts both for taxpayers and the economy. Firstly, bracket creep violates the principle of tax fairness. People with lower and middle incomes can be subjected to an increased tax burden even if their income hasn’t actually risen. This makes the tax system unfair and disproportionate.

Secondly, bracket creep exacerbates social inequalities. People with lower incomes who are not able to increase their incomes at the pace of inflation are more heavily burdened by tax increases. In contrast, people with higher incomes whose salaries rise faster than inflation may feel the effects of bracket creep less.

Thirdly, bracket creep affects entrepreneurs and investors. Lower tax income brackets can lead to restricted investment or reduced economic activity, which can slow down economic growth and the creation of new jobs.

Who is most affected by bracket creep?

Bracket creep primarily affects low earners, both those with the lowest and those with middle incomes – this is due to the applicable tax system in Germany. The German tax system stipulates that income up to the basic allowance of 12,084 euros is not taxed; from the basic allowance onwards, incomes are taxed at a rate of 14 percent.

The tax progression curve initially rises quite quickly and then flattens out. High earners, especially those with an annual income of about 66,779 euros, benefit from this phenomenon as the tax rate remains constant at 42 percent. Only from an annual income of 277,826 euros do an additional 3 percent apply, so that the maximum rate is 45 percent.

Only with an annual income of more than 277,826 euros are an additional 3% added, resulting in a maximum limit of 45%.

In contrast, at lower incomes, the changes are much more noticeable – even a small raise can trigger a switch to a higher tax bracket. As previously mentioned, this does not always lead to an actual increase in net income, as the higher taxation cancels out the benefits of the raise.

The phenomenon of bracket creep therefore affects high earners far less than workers with lower incomes. For this reason, the German authorities decided to introduce a package of tax reliefs in 2025. One element of these changes was the increase in the tax allowance to 12,084 euros to mitigate the effects of bracket creep on lower income groups.

Tax income brackets in Germany and bracket creep

A factor contributing to bracket creep in taxation is the lack of regular adjustments to tax brackets by government authorities. When such measures are neglected, people can end up in higher tax classes even though their income increase is only due to inflation and not an actual income increase.

In Germany, income remains tax-free up to the basic allowance – the allowance is 12,096 euros in 2025 – it should be noted, however, that the amount of the allowance is adjusted annually. This is to ensure that the subsistence level is not further reduced by tax deductions.

When income exceeds the basic allowance, taxation begins with the initial tax rate of 14% and increases with each additional euro of income earned.

Maciej Szewczyk

He gained experience as a consultant on IT projects for many international companies. In 2017, he founded the startup taxando GmbH, where he developed the innovative tax app Taxando, which simplifies the filing of annual tax returns.

Maciej Szewczyk combines technological expertise with in-depth knowledge of tax regulations, making him an expert in his field. In his private life, he is a happy husband and father and lives with his family in Berlin.