Many people enjoy a cold blond beer after work or on the weekend. In keeping with Beer Day on August 7, we investigated how much the federal government and states earn in taxes from the popular barley drink.

The beer tax is calculated based on the original gravity, which varies among beer types and is measured in degrees Plato. Bock beer usually features the highest degree, which is why this type of beer is subject to the highest tax:

Tax revenues from beer are a state matter. The Federal Statistical Office has published the official figures of each federal state for 2019. We have compiled the results:

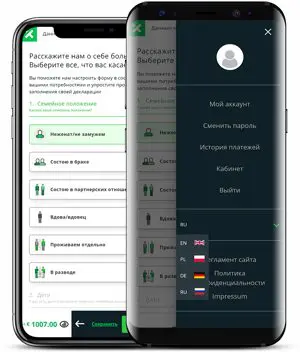

A simple tax return in 12 minutes?

Choose Taxando!

About the investigation

Based on the original gravity (in degrees Plato) of the 20 most popular beer brands in Germany, the average degrees Plato of the different types of beer (Pils, Wheat, Bock, Dark, Light, Malt Beer, and Radler) was calculated. Using the Federal Ministry of Finance’s formula (0.787 euros per degree Plato for a hectoliter of beer), the tax charges for a crate of 20 bottles each containing 0.5 liters, as well as for the German per capita consumption of 99.7 liters, were calculated. The information on beer tax revenues of the federal states can be found in the 2019 Statistical Yearbook of the Federal Statistical Office. The beer tax is an indirect tax, which means that it is charged to breweries that produce over 200,000 hectoliters per year in this manner. These breweries, in turn, pass the costs on to consumers.

Maciej Szewczyk

He gained experience as a consultant on IT projects for many international companies. In 2017, he founded the startup taxando GmbH, where he developed the innovative tax app Taxando, which simplifies the filing of annual tax returns.

Maciej Szewczyk combines technological expertise with in-depth knowledge of tax regulations, making him an expert in his field. In his private life, he is a happy husband and father and lives with his family in Berlin.