Featured in the Following Publications

Why choose Taxando?

Founded in 2016 by two friends who were frustrated by bureaucratic bottlenecks, we have grown from humble beginnings to become one of Germany’s leading tax preparers. Our customers trust us to get results

+50 000

active users

Convenience That Fits Your Life

Finish your taxes anywhere, anytime — on your phone or tablet. Whether you’re on the train, at a café, or between meetings, Taxando goes with you.

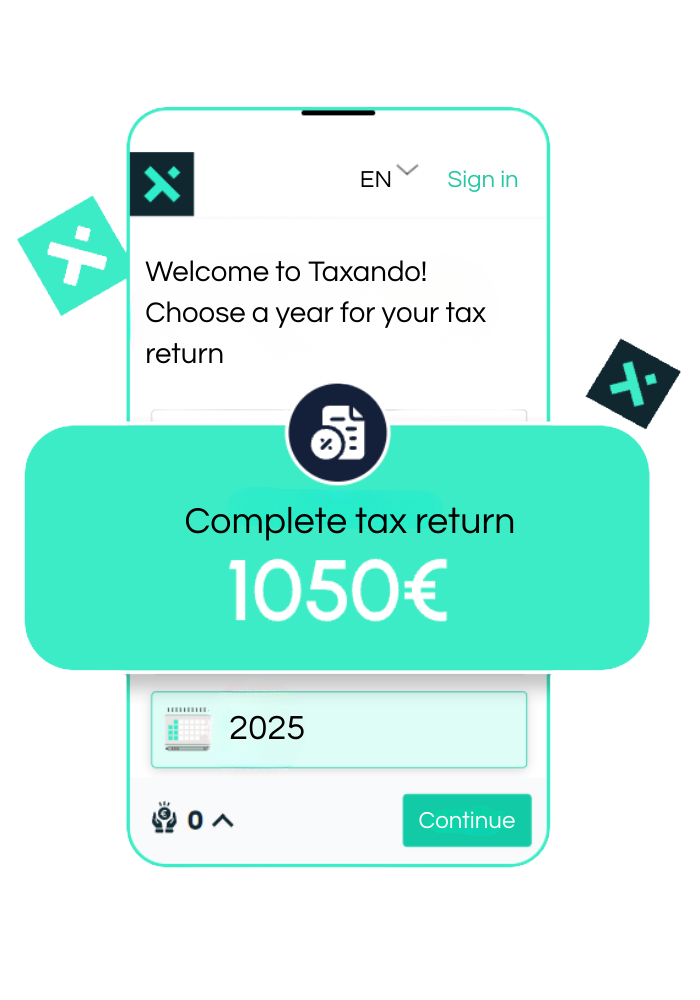

Instant Clarity on Your Return

No more waiting or guessing. Get a live estimate of your refund or payment the moment you enter your data.

Ridiculously Simple Data Entry

Just snap a photo or upload your tax statement — and you’re practically done. Taxando handles the heavy lifting.

Real People, Real Support

Taxes can be stressful. That’s why our tax advisors are on hand to guide you, answer questions, and give you confidence.

Results That Pay Off

Our users get back an average refund of €1,072 — money you might otherwise leave on the table.

Trusted by Tens of Thousands

Taxando users rate us 4.8 out of 5 stars — and we’re confident you’ll love it too.

Getting started is free.

Your peace of mind is priceless.

The Features that Set Taxando Apart

Data Security That Exceeds Standards

Your information is safe. We meet or exceed all German data protection regulations (DSGVO/GDPR compliant).

Multi-Platform Access

File and manage your taxes on Android, iOS, or your desktop browser. Seamless syncing across all devices.

Pro-Level Support

Need help? Get personal guidance from certified tax advisors through the premium service.

Smart Document Upload

Upload your Lohnsteuerbescheinigung (tax card) as a photo or PDF. The app automatically extracts and enters the data.

Say Goodbye to Tax Anxiety

Before Taxando

After Taxando

Choose your simple pricing plan

Standard

Self-assessment

From €0

The Standard package includes:

The price is based on the tax return result and the type of income.

Simple and transparent pricing – you only pay when needed!

Taxes to pay – 0 € (absolutely free!)

No taxes to pay – € 34,9

Income from one activity (either Freelance or Gewerbe) – € 79,90

Income from multiple activities (combination of Freelance and/or Gewerbe) – € 99

Clear rules. No hidden fees.