The basic tax relief, also known as the tax allowance, is an essential part of the German tax system. This relief ensures that a portion of the income earned remains tax-free, which contributes to reducing the tax burden towards the tax office. This has a significant impact on improving the financial situation of workers in Germany. What new developments does the year 2025 bring in this area? How high is the basic tax allowance in 2025 and how can one benefit from it? This article provides answers.

What is the tax allowance?

The tax allowance, or the basic tax relief, is the part of income that is exempt from taxation. It is the minimum amount necessary to meet basic living needs, based on the current economic situation. This amount is set annually by the German government and adjusted according to inflation, depending on the economic conditions of the country.

This tax-free portion of income is not taxed. If individuals earn less or exactly this amount, income tax is omitted. For higher earnings, only the portion of income above this allowance is taxed. This way, the state relieves those with lower incomes.

All taxpayers can benefit from the basic tax allowance in 2025:

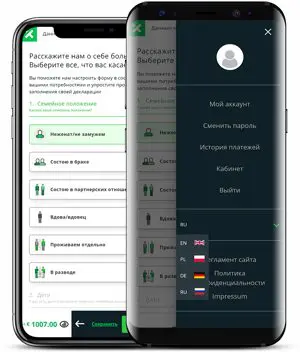

A simple tax return in 12 minutes?

Choose Taxando!

- Employees,

- Self-employed,

- Interns,

- Students,

- Pensioners.

The basic allowance is automatically considered in the payroll tax calculation. Especially individuals in tax class I, who have only one employment relationship, often ask themselves, if they need to file a tax return at all. The answer depends on various factors, but even without obligation, a voluntary tax return can be worthwhile to get back overpaid taxes.

Especially families with children benefit from various tax reliefs. In addition to the basic allowance, there are other supports like the child allowance, child benefits, or the child bonus 2025 – an additional financial aid that parents can apply for under certain conditions.

Tax relief 2025 in Germany – How high is it?

In 2025, there was a renewed increase in the basic tax allowance. This is a regular adjustment that has been taking place for many years.

The tax allowance in Germany for 2025 amounts to 12,084 euros, an increase of over 300 euros compared to the previous year. People whose annual income does not exceed this amount do not pay income tax. Those who earn more only tax the exceeding amount.

Basic tax relief 2025 for married couples

The basic allowance for married couples in 2025 is 24,168 euros. This applies to couples who opt for joint assessment. This regulation allows utilizing the tax-free amount together. The same relief also applies to retired couples who file a joint tax return.

How can I utilize the basic tax allowance?

To claim the basic tax allowance in 2025, a tax return must be submitted to the German tax office. This can be done independently, with the support of a tax advisor, or by using tax software. It is important that the basic allowance 2025 is considered in the return and is automatically entitled to all taxpayers without the need for additional steps.

The most commonly used method for the tax return in Germany is using the official tax office’s website and the ELSTER system. This platform enables the complete online submission of the tax return – a quick, convenient, and secure option.

Timely submission is important

When submitting the tax return, you must take the legal deadlines into account. Those who miss the deadline and are obliged to submit receive reminder letters from the tax office, which can lead to serious consequences. Late fees and fines can be avoided by acting in time.

For processing and claiming the basic allowance 2025, it is sufficient to create an account, choose a username, provide the email address, date of birth, and tax identification number. After confirming the identity, the required forms can be filled out, and the relevant details can be provided according to the payroll tax certificate.

Basic allowance 2025 – how is it calculated?

The calculation of the basic allowance 2025 is based on a report prepared every two years by the federal government on the social minimum, which is based on the current economic situation and determines the tax-free sum for the next two years.

The social minimum for determining the tax allowance is calculated based on the real subsistence level, taking into account factors such as expenses for food, clothing, personal hygiene, housing, heating, healthcare, education as well as leisure and culture. The aim of the basic allowance 2025 is therefore to

ensure minimum living conditions to meet basic needs and lead a dignified life.

Basic allowance 2025 – outlook for the following years

The year 2025 brought many changes in the area of the basic allowance in Germany, yet one thing remains clear: The basic allowance is a crucial component that helps save money and cover basic living costs. This tax-free amount can be benefited from by filing one’s tax return through the tax software Taxando.

Maciej Wawrzyniak

In his private life, Maciej enjoys sporting challenges, playing the guitar, and swimming in the lake. He is also the proud father of three sons.