Tutoring can help catch up on school backlogs and improve children’s grades. Parents often decide to provide their children with this additional form of education. However, this comes with high costs, as qualified individuals must be paid well for their services. So, can tutoring be deducted from taxes? In this article, we try to answer this question.

Tutoring and taxes – How does individual instruction work in Germany?

If the child increasingly brings home poor grades and their performance steadily declines, this could mean they are falling behind in the curriculum. In many cases, it is worthwhile to react quickly to avoid an accumulation of backlogs. Poor grades can negatively affect the child’s mood and self-esteem, leading to discouragement. In the worst case, this can lead to retaking exams or repeating classes, which is associated with great stress. Often, the solution to such problems is providing additional private lessons – however, this involves significant costs. So, can tutoring be deducted from taxes?

Can I deduct tutoring from taxes?

Tutoring in Germany generally cannot be deducted from taxes when submitting the annual tax return. It is not considered child care costs, as it involves private expenses. The legislator stipulates that this should be covered by child benefit and the child allowance. However, there are two exceptions:

- The family moves, and the child has to change schools.

- The child has proven learning difficulties (e.g., dyslexia).

Possibility to deduct tutoring from taxes when moving

Tutoring can be deducted from taxes if you move and the costs incurred are due to the child’s school change. A simple school change, however, is not recognized as a reason. For tax purposes, it must be a move for professional reasons. In this case, it is sufficient if a parent’s commute to work is shortened by at least 60 minutes – it does not matter whether the move is within the same federal state or to another federal state.

A simple tax return in 12 minutes?

Choose Taxando!

If the conditions for tutoring costs are met, these can be deducted as income-related expenses. The maximum amount of tuition costs from 2024 is 1181 €, of which 75% are recognized by the tax office as moving expenses.

Deduction of tutoring from taxes for health reasons

Tutoring costs can also be deducted from taxes if a child has been diagnosed with learning problems. This must be substantiated by a medical certificate (learning difficulties must be based on a brain function disorder, as general weaknesses in reading and spelling are not recognized by the tax office). This is considered as expenses for the treatment of a child with dyslexia and recognized as an extraordinary burden.

There is another condition that must be met to deduct tutoring costs as an extraordinary burden – the threshold of ‘reasonable personal burden’ must be exceeded. In this case, it is between 1 and 7 percent of the total taxable income.

To try to deduct tutoring from taxes in this way, it is extremely important to collect all evidence of the incurred costs – invoices and receipts that can be attached to the tax return.

How much does tutoring cost in Germany?

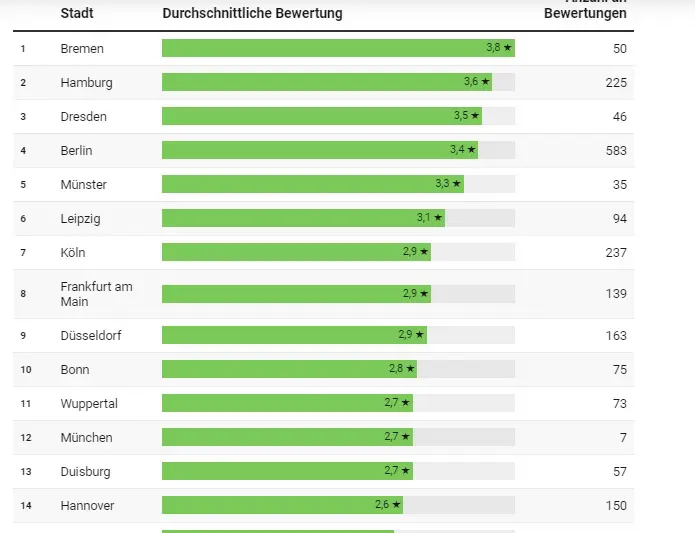

Private tutoring in Germany is mainly offered by older students, university students, or retired teachers. The prices vary greatly here and usually depend on the level of knowledge conveyed and the experience of the tutor. In fact, we also have to consider that the amount may vary depending on the region.

With less experienced and qualified individuals, you can find offers with an hourly rate of 9.35 euros to 15 euros. The services of professional teachers who have been teaching for many years are already a significantly higher expense – sometimes the hourly rates are between 20 and 30 euros per lesson.

With commercial companies that offer group tutoring, you usually encounter a monthly flat fee between 99 and 145 euros and the need to sign a contract with a fixed term and cancellation period.

In the interest of the child, it is worth considering which form of tutoring best helps improve knowledge. Much depends on the child’s character here – with private lessons, the tutor focuses entirely on the student and the lesson is individually tailored, while group lessons can lead to more learning motivation. Therefore, it is worth carefully considering the decision when deciding to send the child to tutoring, and not only to consider the costs.

Tax refund for tutoring – get your money back with Taxando

If you do not meet the conditions from the above-mentioned cases, you must bear the costs for additional lessons yourself and cannot deduct tutoring from income tax. However, there are many other opportunities related to child rearing that the tax office provides.

If you are looking for a way to handle all formalities from Germany favorably, use our Taxando application. It offers everything you need – exceptional efficiency and user-friendliness. In the PREMIUM package, you receive, among others, professional support through tax advice and many other interesting options. We invite you – Taxando.

Maciej Szewczyk

He gained experience as a consultant on IT projects for many international companies. In 2017, he founded the startup taxando GmbH, where he developed the innovative tax app Taxando, which simplifies the filing of annual tax returns.

Maciej Szewczyk combines technological expertise with in-depth knowledge of tax regulations, making him an expert in his field. In his private life, he is a happy husband and father and lives with his family in Berlin.