Church tax: In this state, the churches have the highest loss of members and contributions to report

The Catholic and Protestant churches in Germany receive a substantial portion from the salary of their members – nine percent in most federal states, eight percent in Bavaria and Baden-Württemberg. Recently, however, resignations from the Catholic religious community have increased. What such departures mean for the financing of the churches was examined based on the most recent official exit figures from 2019, calculating how many euros of church tax the Catholic Church missed in each federal state.

In the following graphic, both the resignations and the calculated approximate losses due to the departures can be tracked:

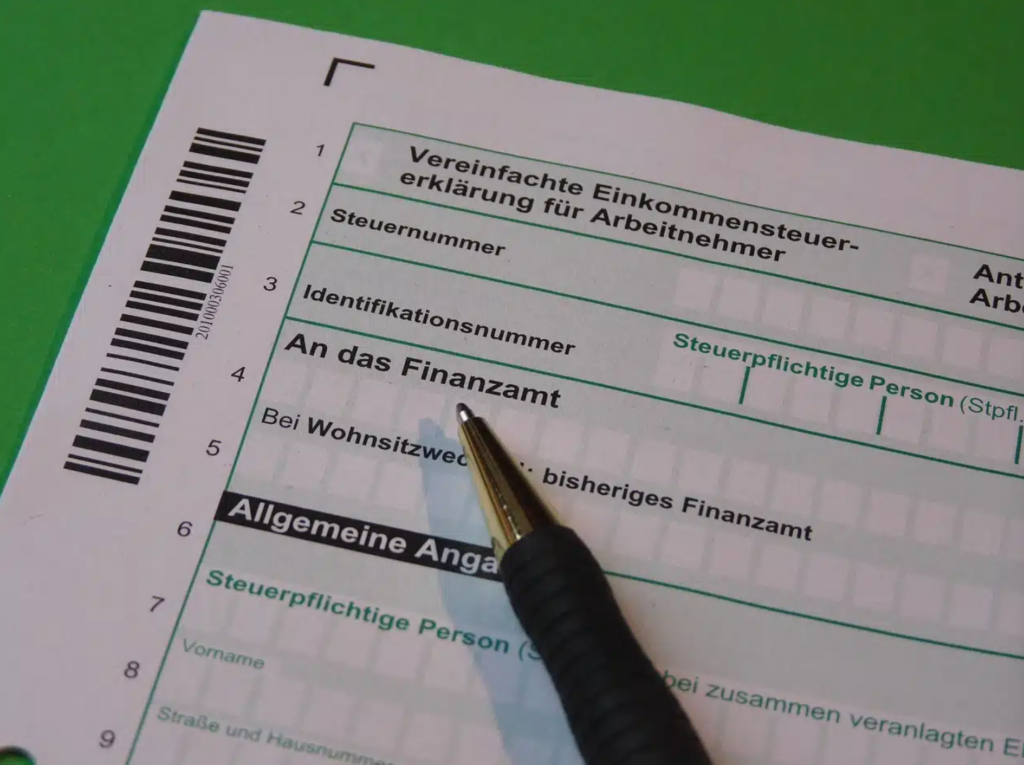

A simple tax return in 12 minutes?

Choose Taxando!

Despite resignation, continuation of church contribution payment? – Tips around the church tax

In principle, there is only a church tax obligation for registered members of a religious community that levies taxes. If both spouses are in such a community and one of them resigns, this does not necessarily mean that the couple is completely exempt from a contribution.

In interfaith marriages and with a joint taxable income of over 30,000 euros, the “special church money” comes into effect. Even if the tax is then levied on the non-denominational partner, it is lawful. Interfaith difference concerning the special church money means either one person is non-denominational and the other belongs to a tax-levying religious community, or one of the two individuals belongs to a religious community that does not levy taxes, while the other does.

To avoid a payment of the special church money, couples can opt for individual assessment, which, however, is often more expensive in the end. Judicially, the person belonging to the tax-levying denomination could take action against the church money.

Maciej Szewczyk

He gained experience as a consultant on IT projects for many international companies. In 2017, he founded the startup taxando GmbH, where he developed the innovative tax app Taxando, which simplifies the filing of annual tax returns.

Maciej Szewczyk combines technological expertise with in-depth knowledge of tax regulations, making him an expert in his field. In his private life, he is a happy husband and father and lives with his family in Berlin.