A wedding is a significant event and a serious step in the lives of many people. It is often associated with great emotions and wonderful memories, but unfortunately also with considerable expenses. When planning an elaborate celebration, costs for clothing, food, music, and decorations arise. For this reason, people look for ways to save, particularly questioning if wedding costs are tax-deductible.

Can wedding expenses be deducted from taxes?

Unfortunately, the costs incurred by a wedding and the associated celebration are not tax-deductible. The German tax office does not offer a direct way for this, as these expenses cannot be assigned to a relevant tax-exempt category. However, in certain cases, there is a chance to recover part of the funds spent on the celebration.

The German state views the wedding as a private event that is not considered for tax purposes. However, the wedding does affect later tax returns, as it allows for the submission of a joint declaration with the tax office, which will be discussed later.

How to deduct the wedding from taxes – how does it work?

Although wedding expenses are not directly deductible, there are still ways to reduce costs. One option is to declare the salaries of the people hired for the organization in the tax return as ‘household-related services.’ This term refers to activities that are privately commissioned and could also be performed by oneself, one’s partner, or a family member.

A simple tax return in 12 minutes?

Choose Taxando!

Deducting wedding costs from taxes – which services qualify?

Material expenses, such as rent for premises, furniture, or food, are unfortunately not recognized as deductible costs. It only involves services provided by hired individuals to assist with the organization of the wedding celebration.

Deductible household-related services include, for example:

- Chef,

- Service staff,

- Catering service,

- Childcare,

- Cleaning team,

- Garden design,

- Decoration.

There is no precise list of specific expenses that fall into this category; they are reviewed individually by the office. It should be noted that deducting wedding costs from taxes is possible under certain conditions.

How do you deduct wedding expenses?

For expenses to be recognized as household-related services, certain criteria must be met. The deduction only concerns the service, not the material or travel costs. An invoice for the service provided is required and must be paid by bank transfer – cash payments are not recognized.

Another condition is that the service must be performed at home. This means that the wedding must take place in one’s apartment or garden. At a celebration in a hall or restaurant, only the services performed at home can be deducted.

How much can you deduct for the wedding from taxes?

For household-related services, you can deduct 20% of the incurred costs annually, up to a maximum amount of 20,000 euros. In this way, you can claim a maximum of 4,000 euros per year in your tax return. With these tips, you can recover part of the expenses.

Wedding and tax benefits – how does marriage affect the tax return?

Marriage leads to the possibility of a joint tax return, which often results in better conditions and higher refunds. This can be particularly beneficial with large income differences, as incomes are pooled together. You and your partner can choose between different tax class combinations, with classes III and V being advantageous with large income disparities, and class IV being beneficial with similar incomes.

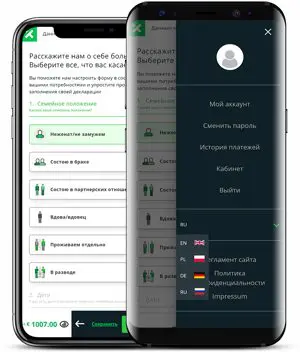

Wedding costs in the tax return – use the Taxando app

For the tax return in Germany, using Taxando is recommended. This simple tool helps to identify the best deductions and can be used conveniently via phone or laptop. Download the app for the tax return from Germany and try it out for free.

Maciej Szewczyk

He gained experience as a consultant on IT projects for many international companies. In 2017, he founded the startup taxando GmbH, where he developed the innovative tax app Taxando, which simplifies the filing of annual tax returns.

Maciej Szewczyk combines technological expertise with in-depth knowledge of tax regulations, making him an expert in his field. In his private life, he is a happy husband and father and lives with his family in Berlin.