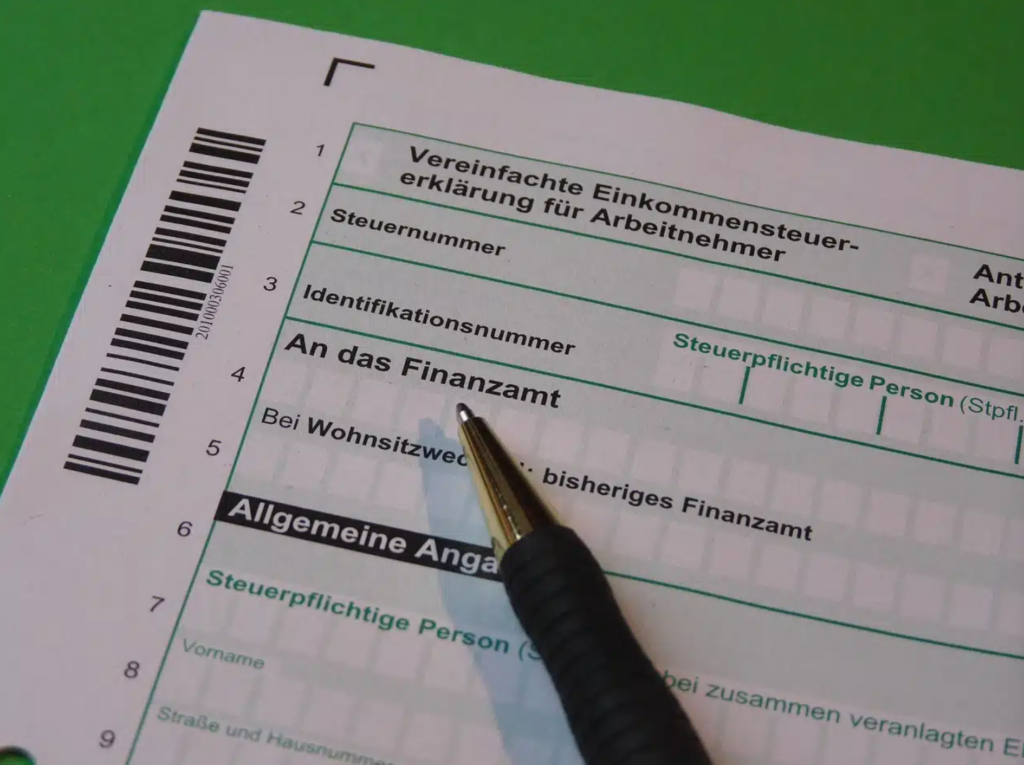

The current tax system in Germany consists of several tax classes. The 1st tax class raises many questions. What does the tax return for tax class 1 look like? Who must submit a tax return to the tax office? Is it worth submitting tax returns for tax class 1? In this article, we will answer the most common questions about tax class 1 for you.

What is tax class 1?

Do you have to file a tax return with tax class 1? First, you should understand what tax class 1 actually is and who it applies to.

The current tax system has 6 tax classes. Which one you are assigned, primarily depends on the family situation you are in. However, as an employee, you have some freedom of choice. Married couples, for example, can choose between tax class IV, III, and V.

But who is tax class 1 intended for? This tax class mainly concerns single individuals. The following persons belong to this class:

A simple tax return in 12 minutes?

Choose Taxando!

- Singles

- People who do not live at the same address as their children

- Divorced persons

- Married couples who live permanently separated (separation)

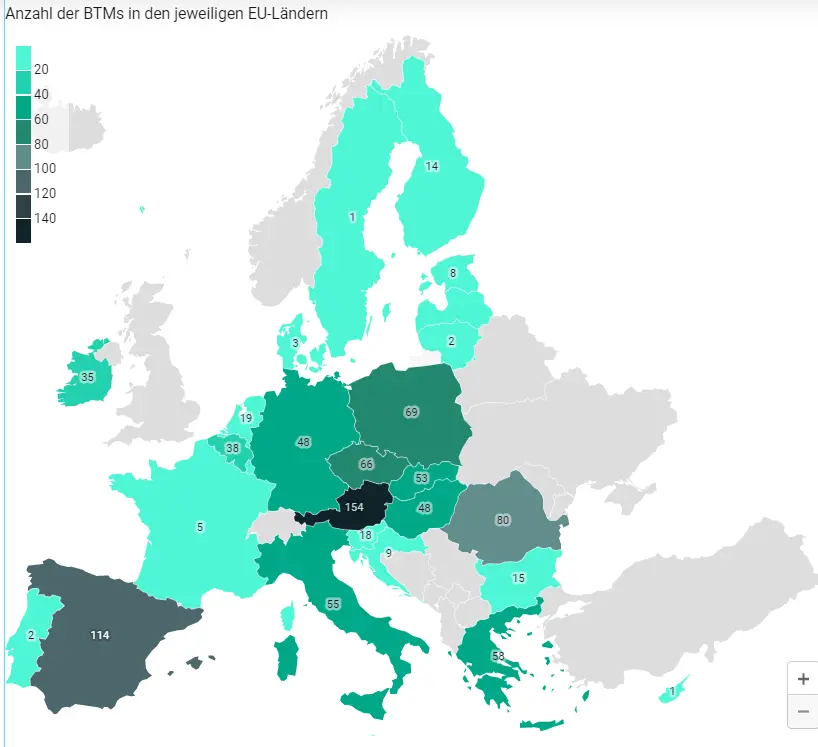

- Marriages where one of the spouses lives in a country outside the European Union

- Widows (from the second year after the spouse’s death)

Do I have to file tax returns in tax class 1?

“Do I have to file tax returns in tax class 1?” – this is one of the most frequently asked questions. And the question is not quite so simple. Who has to file a tax return?

Tax class 1 tax return – tax exemption amount

In tax class 1, certain deductions and allowances are provided that reduce the income tax. For example, if the sum of the granted tax reliefs is €10,000 and your income is €30,000 per year, you pay tax on the difference between these amounts, so tax on €20,000. In the following table, you will find information on non-taxable reliefs and amounts (as of 2024).

| Tax relief | Relief amount |

| Basic tax allowance | €10,908 |

| Employee lump sum | €1,230 |

| Other flat-rate social expenses | €36 |

| Flat-rate pension | Depending on income (gross) |

| Child benefit | €8,952 |

Average tax refund for the tax class – use our calculator now!

The tax return for tax class 1 depends on the individual situation of the taxpayer, particularly on the amount of income earned. Thus, it is quite difficult to clearly determine the average amount of the tax refund.

However, this amount can be calculated with our calculator . You can find this tool in our tax return app Taxando. Our program takes into account your family situation, the tax year, your tax allowances, and your tax class. Thanks to this information, you’ll know what tax refund you’ll receive – even before you send your tax return. Try the calculator directly!

further links:

Maciej Szewczyk

He gained experience as a consultant on IT projects for many international companies. In 2017, he founded the startup taxando GmbH, where he developed the innovative tax app Taxando, which simplifies the filing of annual tax returns.

Maciej Szewczyk combines technological expertise with in-depth knowledge of tax regulations, making him an expert in his field. In his private life, he is a happy husband and father and lives with his family in Berlin.