Before discussing part-time work and mini-jobs in Germany, it is important to understand the German tax system. Germany has one of the most complex tax systems in the world, with different tax rates and benefits that vary depending on employment status, income, and other factors. What does this look like with a side job?

When is a side job referred to in Germany?

Let’s start with the definition. In Germany, a side job is referred to when this employment does not represent the sole source of income and is mostly a supplement to the main employment. Such a position must not exceed two-thirds of regular full-time working hours, which categorizes it as part-time work, i.e., half-time.

However, it is important that as soon as the monthly income from this side activity exceeds 556 euros, a different employment status is reached. This means that insurance obligation kicks in. Therefore, it is important to be aware of these nuances to avoid unpleasant surprises in the form of additional responsibilities and the taxation of the side job.

Taxes in the Side Job

If more than 556 euros are earned with a side job, mandatory contributions to various insurances must be expected. Contributions for pension, health, and long-term care insurance as well as unemployment insurance are automatically deducted from the salary.

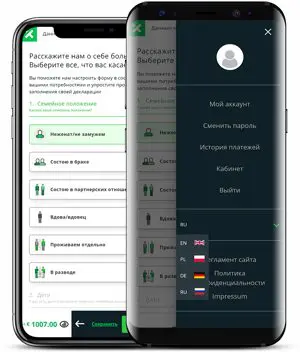

A simple tax return in 12 minutes?

Choose Taxando!

If there is already a main employment, the additional income is taxed according to tax class VI. This means that every euro earned is subject to very high tax rates, as in this case, the benefits that are already considered in the main job cannot be taken advantage of. In addition, other mandatory fees, such as the solidarity surcharge and, if religious and a member of a church, the church tax must be taken into account. All this means that a side job in Germany can be associated with a significant tax burden. However, there is the possibility of exercising a side job tax-free – known in Germany as a mini-job.

Germany can be associated with a significant tax burden. However, there is the possibility of exercising a side job tax-free – known in Germany as a mini-job.

Part-time work tax-free – only as a mini-job

Part-time work and mini-jobs are two different forms of employment in Germany. In a part-time job, a certain percentage of a full-time position is worked, usually between 20 and 30 hours per week. A mini-job, on the other hand, is employment where no more than 556 euros per month are earned and is exempt from some tax and insurance obligations.

Thus, employment as a mini-job is the only way to work part-time tax-free in Germany.

Tax regulations for mini-jobs

Usually, a mini-job is exempt from income tax and social security contributions, but there are exceptions. For example, if more than one mini-job is held, the total income from these employments may be taxable.

Basically, if you earn up to 556 euros per month through a mini-job in Germany, there are two taxation options. The employer decides on this: They can either apply a flat-rate tax of 2% or choose a more individualized approach that considers specific tax deduction possibilities.

If the employer chooses the flat-rate tax, this means no tax obligation for the mini-job. In this case, no tax-relevant documents are received, and this income does not need to be declared in the tax return. This is relevant because the income is so low that it does not exceed the annual tax-free allowance in Germany, which is 12,084 euros in 2025.

The final obligation to submit a tax return with the German tax office does not depend on whether a mini-job is performed or not. There are various other circumstances that can require the submission of a tax return, regardless of whether additional money is earned through a mini-job or not.

Tax return for mini-jobs as a pensioner

Basically, as a pensioner in Germany, a tax return must be submitted if the taxable portion of the annual gross pension exceeds 12,084 EUR. If a mini-job is held, generally no tax return needs to be filed. However, if there are other reasons for tax liability, such as joint assessment with a spouse, a declaration must be submitted to the tax office, in which no information about the mini-job needs to be provided.

Tax regulations for part-time work of students

If a student works part-time, generally the same tax rules apply as for any other employee, with some important exceptions. First, if they work no more than 20 hours per week during the semester, they may be exempt from the obligation to pay health, long-term care, and unemployment insurance contributions. Secondly, if the income does not exceed a certain tax-free amount, no income tax has to be paid.

For example, a student working 20 hours per week earning the minimum wage of 12.41 euros per hour does not have to pay taxes, as the income does not exceed the basic allowance. However, if the income exceeds the tax-free amount, it is taxed according to the individual tax class.

For example, a student working 20 hours per week earning the minimum wage of 12.41 euros per hour does not have to pay taxes, as the income does not exceed the basic allowance. However, if the income exceeds the tax-free amount, it is taxed according to the individual tax class.

Tax return for part-time work

If single, childless, and working between 25 and 30 hours per week, the classification is in the first tax class – in the case of joint assessment, this could be a combination of other classes, such as III/V or IV/IV. If an additional job is taken, it is assigned to the sixth tax class.

job is taken, it is assigned to the sixth tax class.

In the context of the main employment, which is taxed in the first tax class, a certain tax allowance applies, which for the year 2025 amounts to 12,084 euros. Additionally, the tax office grants a so-called employee lump sum, which takes into account work-related expenses before the income is taxed.

Regarding the secondary employment, which is categorized in the sixth tax class, taxation begins from the first euro earned, without any allowances or lump sums that might be claimed in relation to the main employment. Practically, this means that income from secondary employment is taxed significantly more strictly and the tax return is less favorable – this should be considered when deciding for part-time work.

If additional income in Germany is to be correctly declared, the tax app Taxando can help. It allows a tax return to be filed within minutes and offers a favorable tax refund from Germany. Furthermore, the PREMIUM package offers individual assistance with the support of a tax specialist. The entire process takes place online, so it is not necessary to leave home. It is a fast, convenient, and secure solution for tax matters.

Maciej Szewczyk

He gained experience as a consultant on IT projects for many international companies. In 2017, he founded the startup taxando GmbH, where he developed the innovative tax app Taxando, which simplifies the filing of annual tax returns.

Maciej Szewczyk combines technological expertise with in-depth knowledge of tax regulations, making him an expert in his field. In his private life, he is a happy husband and father and lives with his family in Berlin.