All German taxpayers have had to pay an additional charge called the solidarity surcharge in addition to their annual income tax return. What is it, does it still exist in Germany, and how can it be easily calculated? We answer these questions in our article today.

Solidarity surcharge – what is it?

The solidarity surcharge (abbreviated Soli) is a tax levied on the income and corporation tax of individuals working in Germany. It was introduced to equalize living conditions in the East and West and to finance corresponding measures. Since 1991, every worker in Germany has had 5.5 percent of their wage tax deducted from their salary every month (as of 2020).From 2021, however, the solidarity surcharge will be completely abolished for almost 90 percent of German taxpayers as of the 2017 federal election. At that time, it was decided that low and middle income earners should be exempt from the obligation to pay the solidarity surcharge.

Solidarity surcharge – who has to pay?

From 2021, the solidarity surcharge must be paid by any taxpayer who exceeds the stipulated allowance threshold. In addition, capital gains exceeding the saver’s allowance of 801 € are not exempt from paying the Soli. It does not matter whether the employer pays a flat-rate wage tax – the solidarity surcharge of 5.5 % must be paid.

No solidarity surcharge – for whom?

Prior to the changes, low earners did not have to pay the solidarity surcharge, i.e., their annual income tax did not exceed 972 EUR. To now relieve low and middle-income earners from paying the solidarity surcharge, thefederal government has raised the allowance thresholds from 2025:

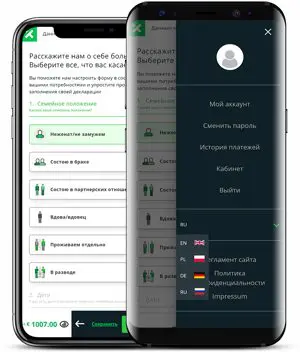

A simple tax return in 12 minutes?

Choose Taxando!

- from 972 € (2020) and 16,956 € (2021) to 19,950 € for single assessments,

- from 1,944 € (2020) and 33,912 € (2021) to 39,900 € for joint assessments of spouses.

The changes in the amounts for income tax compensation and the payment of the solidarity surcharge are not the only innovation. Aso-called mitigation zone has been introduced. It is intended to prevent an employee from having to pay the full amount of the solidarity surcharge if their income exceeds the set exemption limit by a few euros.

Solidarity surcharge – what about entrepreneurs?

Partnerships and sole proprietors with income solely subject to income and business tax can also benefit from the option to not pay the solidarity surcharge. For profit income below the exemption threshold, the Soli is completely abolished. However, looking at the mitigation zone, the abolition will only occur partially.

Solidarity surcharge in 2025 – the latest changes

From 2025, there are changes in the allowances for the solidarity surcharge (Soli). Currently, individuals are exempt from Soli if their annual income tax does not exceed 19,950 EUR, and couples and jointly assessed taxpayers are exempt from Soli if their annual income tax does not exceed 39,900 EUR. About 90% of German taxpayers still do not have to pay this surcharge. In addition, those whose income falls into the mitigation zone benefit from a mitigation mechanism, which allows the Soli to be raised gradually instead of at the full rate of 5.5%. Thanks to these changes, a significant proportion of taxpayers with medium incomes will continue to be financially relieved.

Tax refund of the solidarity surcharge – how is it calculated?

To calculate how much solidarity surcharge you have to pay for your selected tax year, it is worth using ready-made tools that make these calculations easier. One of these is thetax calculation app Taxando, which allows you to quickly, easily, and completely securely calculate all processes related to taxes. Find out how much more convenient it will be for you to calculate your tax refund from Germany with our free calculator.

Maciej Wawrzyniak

In his private life, Maciej enjoys sporting challenges, playing the guitar, and swimming in the lake. He is also the proud father of three sons.