Double Household Management – How You Can Save Money

Do you have a second residence at your place of…

Missed the deadline for your 2024 tax return?

Get our Premium Service with a tax advisor now – the deadline is April 30, 2026!

Missed the deadline for your 2024 tax return? Get our Premium Service with a tax advisor now – the deadline is April 30, 2026!

Do you have a second residence at your place of…

Winter is a special season that can make life difficult…

In Germany, the classification into tax classes plays a crucial…

Airbnb, the global platform for unique accommodations and experiences, breaks…

Taxpayers usually do not have a good opinion of the…

Many German citizens engage in voluntary work. People are actively…

All German taxpayers have had to pay an additional charge…

With the Research Allowance Act (FZulG) of December 14, 2019,…

Every German household – regardless of the number of residents…

Before discussing part-time work and mini-jobs in Germany, it is…

Do you want to leave your estate to your children…

The German state has a very well-developed social system. Among other things, pensioners, the unemployed, people who are sick or have had an accident, as well as people who have lost their jobs can apply for financial support. There are also social benefits for parents in this country. One of them is the child supplement, about which you will learn more later in this article.

Anyone who has ever settled their taxes with the German…

In Germany, submitting an annual tax return is not mandatory for everyone.

Are you currently looking for a new job? We have…

The tax system is constantly changing and evolving. Therefore, you…

The turn of the year brings legal changes every year. Therefore, we have compiled a brief overview of the changes in exemptions and deadlines for you.

The beginning of the year is a time when many changes come into effect. This is no different in tax law, which due to regulations changing from year to year, evokes many daunting feelings among taxpayers. An example of such changes is the tax allowance, which is very popular with a large group of people across the country. What is this tax relief? What is the tax allowance amount in 2023 and what was it in previous years? We discuss the key topics in today’s article – we invite you to read it.

Submitting a tax return for the year 2020 presents special challenges for some employees. Receiving short-time work allowance can affect not only the pension but also the taxes payable.

For an initial registration with Elster, a valid email address is required. You should set a password and choose a security question. After registration, you will receive an activation ID via email and an activation code by mail.

The rush on the crypto market does not wane. More and more investors are acquiring Bitcoin, Ether, or Ripple – cryptocurrency seems to be the investment of the corona pandemic.

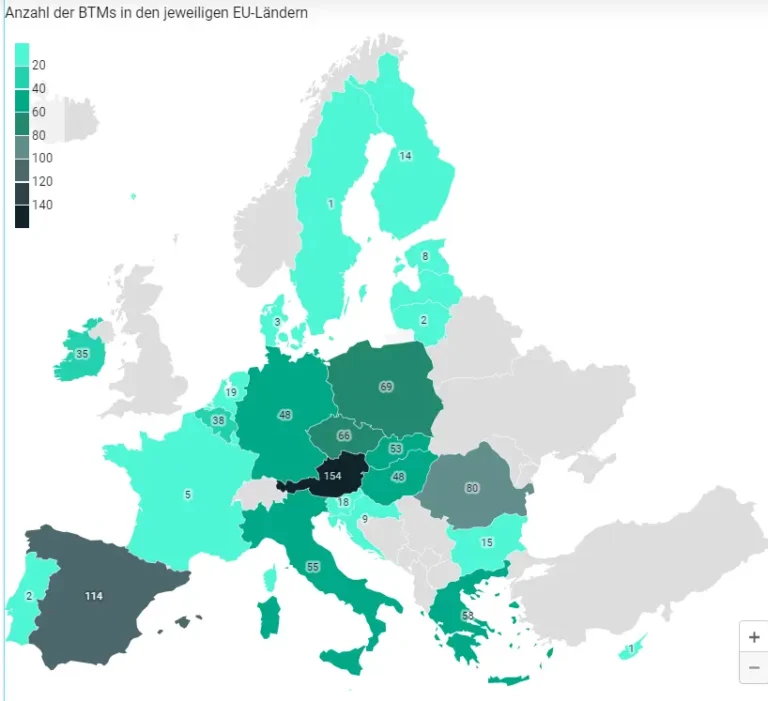

Church Tax: In This State, Churches Have the Highest Loss of Members and Contributions to Report

Many people enjoy a cold brew after work or on weekends. Just in time for the Beer Day on August 7th, we have examined how much the federal government and states earn from the popular barley juice in the form of tax.

Many employees had to swap their office for their home office due to the Corona pandemic. But what should employees in the home office pay attention to? For example, can consumers deduct the newly purchased office chair from their taxes? We have taken a closer look at the existing tax regulations.

For decades, we have been hearing that tax law should be simplified. And for decades, lawmakers have been promising corresponding changes. Hope is the last to die here as well. Sure, a lot is changing, and some things are being simplified along the way.

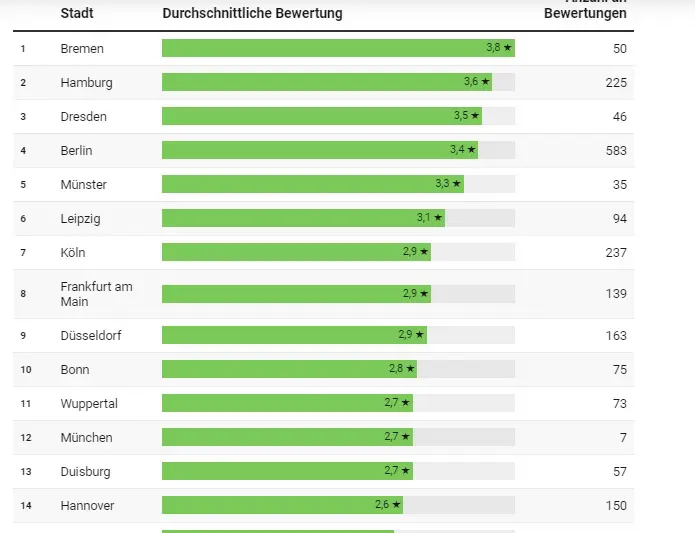

Many taxpayers often face the challenge of completing their tax return correctly and submitting it on time, hoping for a quick processing of their documents. In some situations, direct contact with the tax officials cannot be avoided. We have currently determined how satisfied taxpayers are with the work of the tax offices. For this, we have scrutinized all tax authorities in the 20 largest cities in Germany and analyzed over 2,600 customer reviews from 80 tax offices.

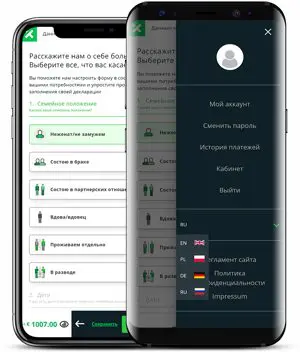

Due to personal experiences with the German tax return, Maciej Szewczyk and Maciej Wawrzyniak founded the Berlin fintech Taxando in 2017. With their product, they aim to fully digitalize the process and make it as time-saving and straightforward as possible. Taxando creates the tax return automatically in about 15 minutes. Users then immediately find out their estimated tax amount.

The first half of the year in Germany always means a busy phase for obligatory tax declarations.

In the past, tax returns were filled out on forms and sent by post to the tax office. Nowadays, thanks to ELSTER, it is easier and faster.

As announced by Federal Finance Minister Christian Lindner, pension contributions…