In Germany, submitting an annual tax return is not mandatory for everyone, but often one can benefit from it. Many taxpayers decide against it due to a lack of sufficient knowledge on how to obtain a beneficial refund or due to lack of funds for the expensive services of a tax consultancy. In this article, we talk about a cheaper alternative that tax aid associations represent.

Who can benefit from tax aid associations?

Let’s start with who can actually apply for membership in a tax aid association. This is quite clearly defined and is regulated by § 4 Abs. 11 StBerG (Tax Consultancy Act). According to this, tax support is available to employees, civil servants, and pensioners, among others.

An important factor is also the income limit of 18,000 euros per year that one may have from rental income, permanent assets, private sales transactions, or other types of income. For jointly assessed members, this income must not exceed 36,000 euros.

Who is not given help in the area of income tax?

Tax aid associations cannot provide advice and do not process self-employed persons, traders, and employees who earn income on their own account. They also do not assist with matters related to inheritances, gifts, or property tax. In these special cases, the best contact is a tax consultancy.

A simple tax return in 12 minutes?

Choose Taxando!

What assistance does the tax aid association offer in the area of income tax?

Is it worth taking the help of a tax association? That depends on many factors – are you new to Germany or unsure about your tax obligations? Are you not interested in government matters, but still want to receive a beneficial refund? Do you have so much to do that you need support? If you answered yes to at least one of these questions, membership might be considered.

This is, for example, excellent tax help for pensioners who often have problems keeping up with new technologies and billing forms, as well as submitting documents to the tax office, and for low-income earners for whom the services of a tax consultancy represent a significant expense.

The extent to which help can be provided with wage tax matters is also defined in § 4 Abs. 11 StBerG. According to this paragraph, the association offers its members support in areas such as:

- Income taxation and associated grants,

- Pension benefits,

- Investment allowances,

- Allowances for homeowners,

- Costs associated with childcare,

- Household services,

- Family benefits,

Income from permanent assets, rent and lease, as well as other income.

How much does membership in a tax aid association cost?

Each tax aid association has its own rules and contribution levels. Usually, you pay a small admission fee and then an annual membership fee that depends on the gross income. As a member, you can take advantage of consultations at any time and do not have to pay separately for each individual service.

The membership fee is generally between 50 and 390 euros, depending on income and association. Additionally, there is an entrance fee of 10 to 15 euros.

The exact fee is usually found on the association’s website – you can also call and ask about the total costs that will be incurred. Before joining, it is advisable to carefully check the status of the organization and review some important elements such as contract duration and cancellation options. This way, we know whether the offered conditions meet our requirements.

Tax-deductible membership fees

The costs of professional tax advice can also be deducted in the annual tax return. All associated expenses that do not exceed 100 euros can be fully deducted – including the membership fee of the tax aid association.

The support of a tax association in Germany – until when must you settle?

The standard deadline for filing tax returns for most taxpayers is July 31 of the following year. Concerning tax returns for the year 2022, the deadlines are as follows:

- October 2, 2023 (instead of July 31, 2023) – deadline for non-recommended matters,

- July 2024 (instead of February 29, 2024) – final deadline for recommended matters.

Tax association nearby – how to find support?

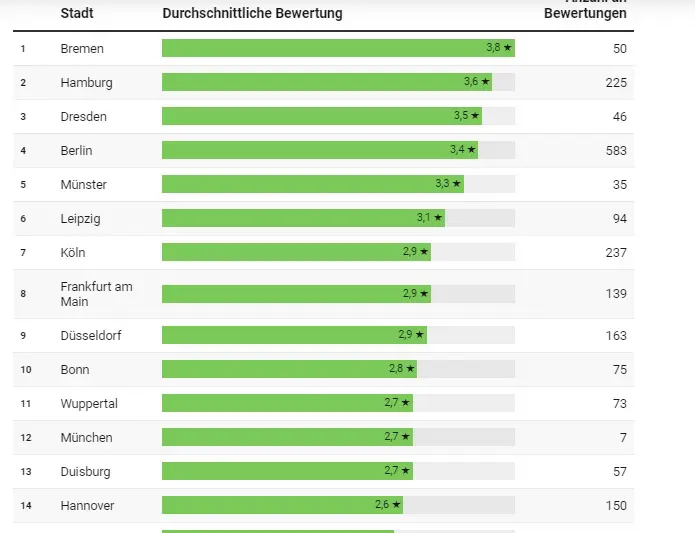

In Germany, about 800 different associations offer tax support, making it easy to find help near your place of residence. There are both local and large organizations that have members nationwide.

Those seeking quick advice on income tax and other finance-related matters in their own region should ideally visit the BVL website. There you can find the nearest offices and evaluate which option fits best.

Association for income tax support or tax consultancy – what should you choose?

The support provided by a tax consultancy is usually one-off – you pay for a specific service rendered. When ordering the filing of the tax return, it is done efficiently and professionally, but the support of the tax consultancy in case of questions or uncertainties is no longer available after a few months.

If long-term support and a relatively low income are necessary, choosing a tax association can be much more advantageous – with a low membership fee, you receive the same service and the opportunity for consultation throughout the year.

The decision between a tax office and an association therefore depends on the individual’s needs – whether long-term support or a one-off service is preferred.

Tax advisor or alternative?

When choosing between a wage tax aid association and a tax advisor, costs often play a role. But what does a tax advisor actually cost? The fees are established in the Tax Advisor Remuneration Ordinance (StBVV) and depend on the value of the matter. Tax advisors offer more comprehensive services and can also help with complex cases. With Taxando PREMIUM, you combine the advantages of modern technology with professional tax advice at transparent fixed prices.

Those who feel capable of submitting their tax return themselves can use the state’s ELSTER program. However, there are no instructions here, so extensive knowledge is necessary. Support is provided by the application for income tax declaration in Germany, Taxando. Everything is designed to be understandable and clear, so no one should have problems filling out their declaration online in a few steps. The whole thing is checked by certified experts when choosing the PREMIUM version.

Maciej Wawrzyniak

In his private life, Maciej enjoys sporting challenges, playing the guitar, and swimming in the lake. He is also the proud father of three sons.