Regardless of whether the studies are completed in Germany or abroad, a university education is often associated with significant expenses, especially when renting an apartment or regularly commuting several kilometers to a distant university town is necessary. Fortunately, the German tax system provides certain benefits for students in Germany, particularly the possibility of claiming certain study costs in the tax return (tax return study costs). This article explains which expenses can be stated in the annual declaration to reduce the tax liability with the tax office. We invite you to read on.

When and how is the deduction of study costs in Germany possible?

The deduction of study costs from taxes is only possible if taxable income was earned in the relevant year. The costs are considered special expenses and are limited to €6,000 per year.

However, it is important to note: Study costs up to €6,000 can be deducted as special expenses. However, if it’s an advanced study related to the exercised profession, the deductions can be made as part of the advertising expenses – in this case, there is no upper limit.

Therefore, a potential refund amount is not paid directly by the German tax office – when income is earned, the study-related expenses listed in the annual tax return influence the reduction of tax liability.

A simple tax return in 12 minutes?

Choose Taxando!

Study costs and taxes in Germany – what can be deducted?

The topic of the deductibility of study-related expenses in Germany has been of great interest for years, which, of course, should surprise no one. This is accompanied by many questions, such as whether tuition fees can be deducted from taxes and the like. What does this look like in practice? Let’s get to the core, namely, the study costs that can be deducted from taxes.

Deduction of tuition fees from taxes

The possibility of deducting tuition fees from taxes is welcome news – up to a maximum of €6,000 per year if these are the only expenses listed in the tax return. This is particularly relevant as semester contributions often count among the highest expenses during studies, sometimes several hundred euros per year.

Deduction of study costs and other expenses

In addition to tuition fees, other expenses can be considered in the tax return. These include purchasing writing materials such as pens, pencils, and fountain pens, as well as accessories like staplers and paper clips. Costs for notebooks, paper, or printer toner are also tax-deductible.

Study costs in the tax return: Commutes to the university

Those who want to claim study costs for tax purposes should also include commutes to the university. Those who commute by their own car can deduct travel expenses of €0.30 per kilometer driven and €0.38 from the 21st kilometer (for the one-way journey).

Rental costs during studies

Renting an apartment or room near the university is often necessary. The rental costs can be considered in the tax return if they amount to at least 10% of the total costs at the main residence.

Return trips home

The costs for return trips home can also be deducted, as already mentioned with the travel costs.

Purchase of a computer

The purchase of a computer necessary for studies can also be deducted from taxes. Since a computer is often used privately as well, a flat-rate amount of 50:50 should be assumed when deducting, i.e., half of the purchase price.

What else can be deducted as a student?

To reduce obligations with the tax office at the end of the tax year, it is worthwhile to list expenses for the following items in the tax return:

- Examination fees,

- Fees for courses, e.g., language courses,

- Purchase of specialist literature,

- Student loans,

- Expenses for legal procedures (legal aid in applying for a study place),

- Printing and binding of theses (bachelor’s, master’s, diploma, doctoral theses),

- Membership fees in student organizations.

Students and the settlement for past years

Finally, it is important to mention a very important question, namely the possibility of settling for past years in Germany. Ordinary taxpayers have the right to submit a tax declaration retrospectively up to 4 years – however, students have a greater privilege – they can submit their declaration to the tax office retrospectively up to a maximum of 7 years.

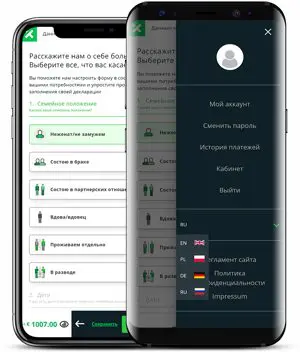

Unsure how to fill out a tax declaration and deduct study costs? No worries – nowadays, you can opt for a special accounting app like Taxando. It’s a simple and intuitive program with which you can fill out a declaration within minutes and consider the reliefs and deductions you are entitled to. We invite you to try it out!

Maciej Szewczyk

He gained experience as a consultant on IT projects for many international companies. In 2017, he founded the startup taxando GmbH, where he developed the innovative tax app Taxando, which simplifies the filing of annual tax returns.

Maciej Szewczyk combines technological expertise with in-depth knowledge of tax regulations, making him an expert in his field. In his private life, he is a happy husband and father and lives with his family in Berlin.